Post Office MIS 2025: If you’re someone who values financial stability and wants a steady monthly income without risking your hard-earned savings, then the Post Office Monthly Income Scheme (MIS) 2025 might be exactly what you need. Whether you’re a retiree looking for a fixed return every month, or simply someone who prefers safe investments over market fluctuations, this scheme offers peace of mind with guaranteed payouts.

Let’s explore how this government-backed savings plan can become your dependable monthly income source in 2025.

What is Post Office MIS 2025?

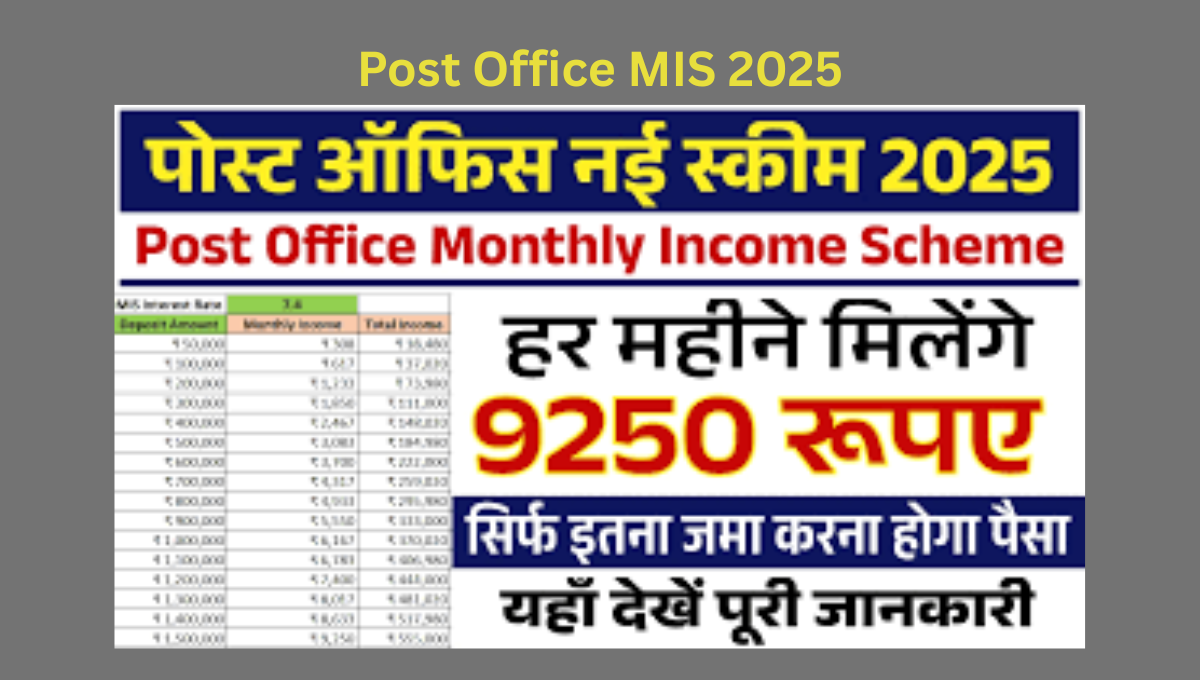

The Post Office Monthly Income Scheme (MIS) is a small savings scheme offered by India Post and backed by the Government of India. In simple words, it allows you to invest a lump sum amount and receive a fixed amount every month as interest income.

What makes it appealing in 2025 is that it continues to offer guaranteed monthly payouts, capital safety, and a low-risk environment, especially for those who do not want to venture into volatile options like mutual funds or stocks.

This scheme is especially popular among:

- Pensioners

- Homemakers

- Retirees

- Parents saving for a child’s education or future needs

The maturity period is 5 years, after which the full principal amount is returned. Throughout this term, you enjoy regular monthly income without any surprises.

Post Office MIS 2025: Key Features You Should Know

The tenure of this scheme is 5 years, which means once you invest, your money remains locked in for that duration. However, you’ll receive interest every month — making it a great choice for those looking to manage daily or monthly expenses with a steady cash flow.

The interest rate is fixed by the government and revised quarterly, so it’s always a good idea to check the latest update from India Post before investing. Even though the returns are not as high as market-linked products, the certainty of income and government guarantee make it a smart choice for risk-averse investors.

Another benefit is that your capital is not only safe but also returned in full once the 5-year term ends. This makes the scheme ideal for anyone who wants to protect their capital while earning a reliable income.

Who is Eligible for Post Office MIS in 2025?

The scheme is open to Indian residents, and the eligibility is straightforward:

- Adults can open a single account in their name.

- Senior Citizens often prefer MIS due to its regular returns.

- Minors above 10 years can also open an account in their own name, or a guardian can open it on behalf of a minor.

You can also open a joint account with up to three people. In joint accounts, the investment limit is shared, and the interest is paid to the account holders collectively.

How to Apply for Post Office MIS in 2025

Applying for the Post Office Monthly Income Scheme is simple and can be done by visiting your nearest Post Office branch.

Here’s how the process works:

- Visit the Post Office where you want to open the MIS account.

- Carry the required documents, which typically include:

- Aadhar Card

- PAN Card

- Recent passport-size photograph

- Address proof

- Fill out the MIS account opening form carefully.

- Submit your documents and deposit the investment amount (you can deposit via cheque or cash).

- Once processed, you’ll receive an account passbook, and your monthly interest will start getting credited to your Post Office savings account.

As of now, online account opening is not available for this scheme, so visiting the Post Office in person is necessary.

The Post Office Monthly Income Scheme (MIS) 2025 continues to be one of the safest and most reliable investment options for those who prioritize stability and assured income. Whether you’re planning your retirement, supporting your family, or just looking to earn a little extra every month, MIS offers a dependable path without any risks.

With the backing of the Indian government, a fixed interest rate, and easy access via your local post office, it’s a practical option worth considering in your financial planning for 2025.

Disclaimer: The information provided in this article is for general awareness and informational purposes only. Interest rates, eligibility, and terms may change as per government updates. Please verify the latest details with your nearest post office or the official India Post website before investing. Always consider your financial goals and consult a financial advisor if needed.

Read more

Viklang Pension Yojana 2025: Apply Online & Get Monthly Pension – Check Eligibility Now!

Aadhaar government scheme check Benefits Using Aadhaar – Easy Online Guide (2025)