national pension scheme india: Planning for retirement is something most of us avoid thinking about until it’s almost too late. But imagine reaching your golden years without any stress of monthly expenses, medical bills, or depending on others financially. That’s where the National Pension Scheme (NPS) comes in — a thoughtful initiative by the Government of India to help you build a financially secure future.

Whether you’re a salaried employee, a business owner, or someone just starting their career, NPS is a powerful tool to ensure your post-retirement life is comfortable and independent.

What is the National Pension Scheme (NPS)?

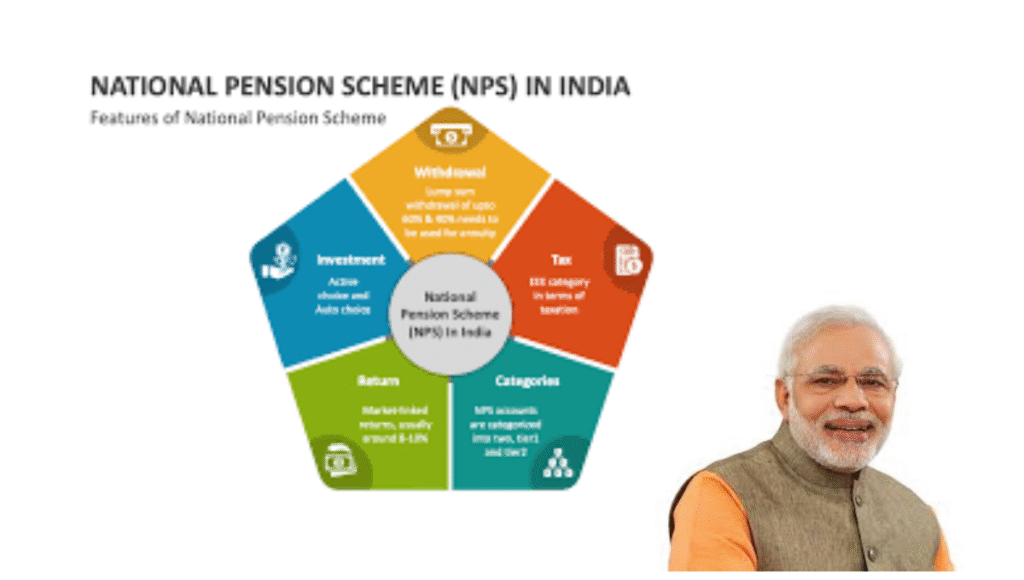

The National Pension Scheme (NPS) is a voluntary retirement savings plan introduced by the Government of India. It’s designed to encourage individuals to save for their retirement in a systematic way while also enjoying the benefits of a professionally managed investment system. NPS is regulated by the Pension Fund Regulatory and Development Authority (PFRDA), ensuring transparency and safety.

One of the major attractions of NPS is its tax-saving potential. Subscribers can claim tax deductions under Section 80CCD(1) within the overall limit of ₹1.5 lakh under Section 80CCE. On top of that, there is an additional tax benefit of ₹50,000 under Section 80CCD(1B), which makes NPS one of the most tax-efficient retirement investment options in India.

Eligibility Criteria for NPS

The NPS is open to all Indian citizens, including Non-Resident Indians (NRIs), between the ages of 18 to 70 years. Whether you are employed or self-employed, you can enroll in the scheme either individually or through your employer (if they offer NPS as part of the salary package).

Joining NPS is not only about financial discipline—it’s about taking charge of your own future. With increasing life expectancy and inflation, retirement planning is no longer optional. It is a necessity.

Why Choose NPS? Here’s How It Benefits You

NPS offers a low-cost investment model with market-linked returns, which means your money has the potential to grow more than traditional savings schemes. It also allows you the flexibility to decide how much you want to invest and how often—monthly, quarterly, or yearly.

You get the freedom to choose your fund manager and investment pattern, whether it’s equity, government bonds, or corporate debt. This level of control is rarely seen in government-backed schemes.

Another comforting feature of NPS is its portability. No matter if you change jobs or move cities, your NPS account stays with you. And when you retire, you can make a partial withdrawal for urgent needs like health care or home purchase, while the remaining amount provides a lifetime pension, ensuring that you live your retirement years with dignity and peace.

How to Register for NPS Online

Getting started with NPS is easier than ever before. All you need to do is visit the official eNPS portal:

https://enps.nsdl.com/eNPS/NationalPensionSystem.html

On the portal, simply fill out the registration form using your Aadhaar number or PAN card, and follow the easy steps to generate your PRAN (Permanent Retirement Account Number). Once your account is created, you can start making contributions and managing your investments online.

So don’t wait. Take the first step today. Secure your future, live with confidence, and retire with pride.

Retirement should be a time to relax and enjoy life—not worry about money. The National Pension Scheme (NPS) is more than just a tax-saving tool. It’s a promise you make to yourself for a financially secure tomorrow. The earlier you start, the bigger your retirement corpus grows, thanks to the power of compounding.

Disclaimer: This article is for informational purposes only. Readers are advised to consult with a certified financial advisor or refer to the official NPS website for the latest rules, updates, and personalized guidance based on their financial goals.

Read more

E-Shram Card Registration 2025: How to Get ₹1000 Government Benefit

Direct Benefit Transfer (DBT): A Complete Guide to Tracking Your Payments