pan aadhaar link online status: If you’ve ever felt confused or worried about whether your PAN is still valid, you’re not alone. Many people across India suddenly realize they haven’t checked their PAN–Aadhaar link status until they hear about penalties or PAN deactivation. The good news is that checking and linking PAN with Aadhaar is simple, online, and takes just a few minutes. In this article, I’ll explain everything in clear, human-friendly language so you can understand what PAN–Aadhaar linking really means, why it matters, and what you should do right now to stay stress-free.

What Is PAN–Aadhaar Linking?

PAN–Aadhaar linking simply means connecting your Permanent Account Number with your Aadhaar number in government records. This helps the Income Tax Department verify your identity accurately and reduce duplicate or fake PAN cards. By linking both, the government ensures that one person has only one PAN, making tax filing and financial tracking more transparent.

The government made PAN–Aadhaar linking mandatory to prevent tax evasion, stop misuse of multiple PAN cards, and simplify digital services. When PAN and Aadhaar are linked, your financial identity becomes cleaner and more reliable across banks, income tax filings, and investment platforms.

Almost all PAN card holders need to link their PAN with Aadhaar. This includes salaried employees, self-employed individuals, freelancers, business owners, and anyone who files income tax returns or uses PAN for financial transactions.

Latest PAN–Aadhaar Linking Update (2025)

As per the latest update in 2025, PAN–Aadhaar linking is still mandatory. If your PAN is not linked with Aadhaar, it may become inoperative, meaning it cannot be used for important financial activities. The government has clearly stated that late linking attracts a penalty.

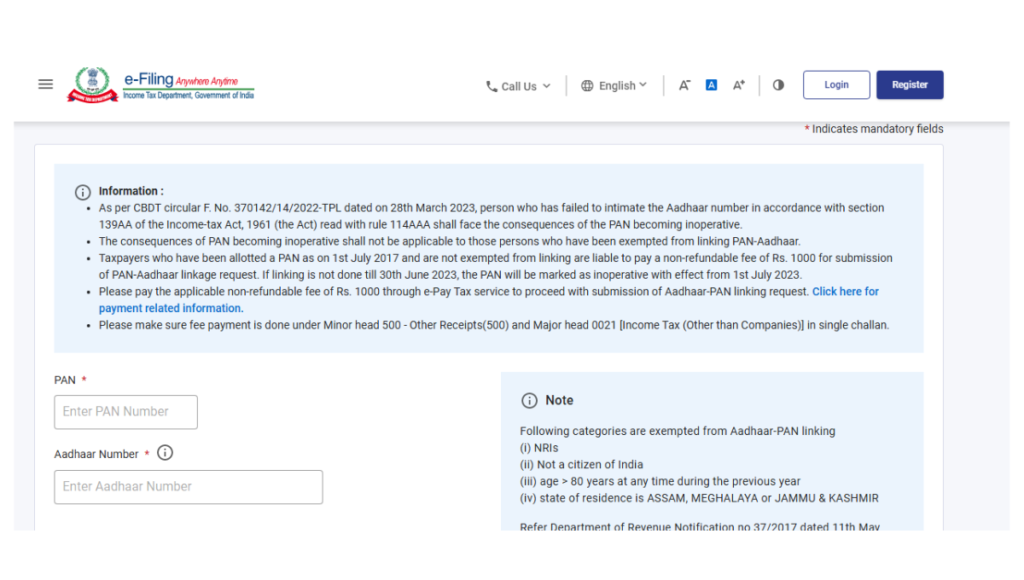

Currently, a penalty of ₹1,000 is applicable if you link PAN with Aadhaar after the prescribed deadline. Once the penalty is paid and the linking process is completed, your PAN can be reactivated.

If PAN is not linked even after reminders, it becomes inoperative. An inoperative PAN cannot be used for filing income tax returns, opening bank accounts, making high-value transactions, or investing in mutual funds and shares.

How to Link PAN with Aadhaar Online

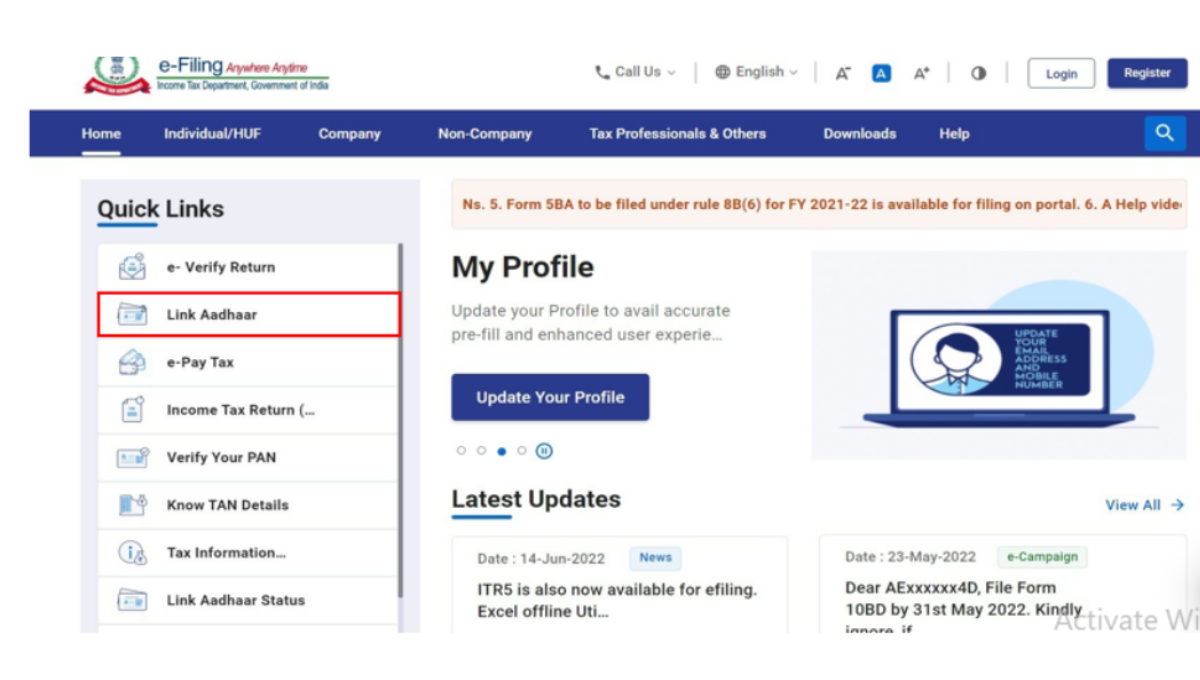

To link your PAN with Aadhaar online, visit the official Income Tax e-filing portal. Under the “Quick Links” section, select the option “Link Aadhaar.” You will be asked to enter your PAN, Aadhaar number, and your name exactly as it appears on Aadhaar records. After submitting these details, you will receive an OTP on the mobile number linked with your Aadhaar. Enter the OTP to complete the PAN–Aadhaar linking process successfully.

How to Check PAN–Aadhaar Link Status Online

Checking your PAN–Aadhaar link status is just as easy and does not require login credentials.

Checking Status via Income Tax Portal

Visit the official Income Tax e-filing website and click on “Link Aadhaar Status.” Enter your PAN and Aadhaar number in the required fields. Once you submit the details, the screen will instantly show whether your PAN is already linked with Aadhaar or not.

Checking Status via SMS

You can also check linking status through SMS. Send an SMS from your Aadhaar-linked mobile number in the prescribed format to the designated number provided by the Income Tax Department. This method works only if your mobile number is registered with Aadhaar.

Understanding Your PAN–Aadhaar Link Status

If your status shows “Linked,” it means everything is fine and your PAN is active for all financial and tax-related activities.

If the status shows “Not Linked,” it means your PAN may already be inoperative or at risk of deactivation. Immediate action is required to avoid further problems.

If the status is “Pending” or shows a mismatch, it usually means there is a difference in name, date of birth, or gender between PAN and Aadhaar records. Such issues need correction before successful linking.

What to Do If PAN Is Not Linked With Aadhaar

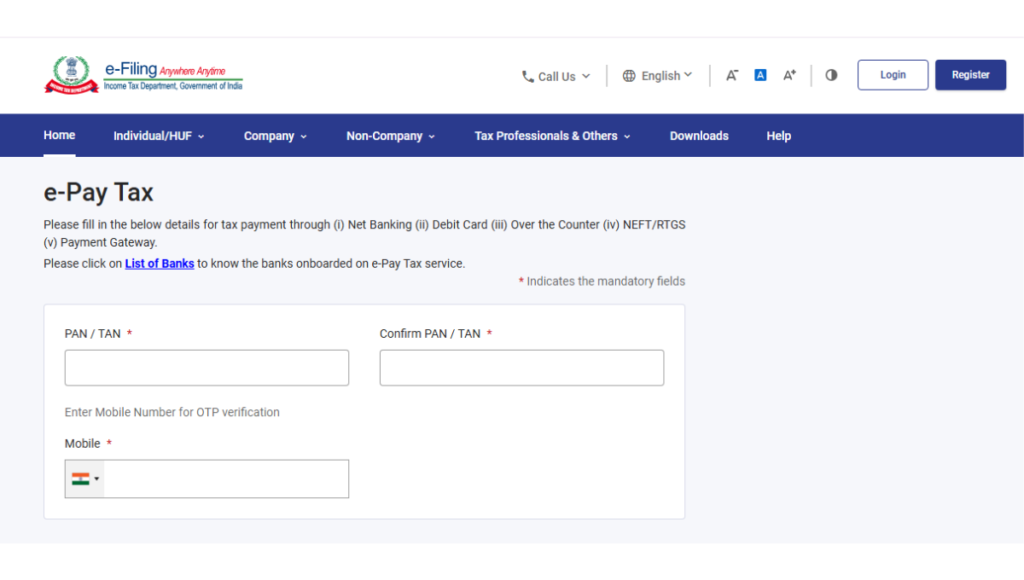

If your PAN is not linked, the first step is to pay the penalty of ₹1,000 through the Income Tax portal. After payment, you can proceed to link your PAN with Aadhaar using the online process. Once the request is submitted, the status usually updates within a few days, although in some cases it may take up to two weeks.

Common Problems While Linking PAN & Aadhaar

Many people face issues due to name mismatch, especially when initials or spelling differ between PAN and Aadhaar. Date of birth mismatch is another common problem, often caused by incorrect details during PAN application. Sometimes, linking fails because the mobile number is not updated with Aadhaar, making OTP verification impossible. Technical issues on the portal during peak times can also cause temporary errors, which usually get resolved by trying again later.

PAN Deactivation Rules Explained

When PAN is not linked with Aadhaar, it becomes inoperative. An inoperative PAN cannot be used for filing income tax returns, opening new bank accounts, applying for loans, or making high-value financial transactions. However, once you complete the linking process and pay the penalty, the PAN can be reactivated, and normal services resume.

Who Is Exempted From PAN–Aadhaar Linking?

Certain individuals are exempted from PAN–Aadhaar linking. This includes non-resident Indians as per the Income Tax Act, individuals above a specified senior citizen age limit in some cases, and residents of notified exempted states. These exemptions apply only under specific conditions defined by the government.

PAN–Aadhaar Linking: Key Details at a Glance

| Particulars | Details |

|---|---|

| Mandatory Linking | Yes (for most PAN holders) |

| Penalty for Late Linking | ₹1,000 |

| PAN Status If Not Linked | Inoperative |

| Linking Mode | Online via Income Tax Portal or SMS |

| Time for Status Update | Few days to 2 weeks |

PAN–Aadhaar linking is not just a legal requirement but a safeguard for your financial identity. Ignoring it can lead to unnecessary penalties, blocked transactions, and last-minute stress. Taking a few minutes today to check your PAN–Aadhaar link status can save you from bigger problems tomorrow. If your PAN is already linked, you can relax. If not, act now and complete the process while it’s still simple.

Disclaimer: This article is for informational purposes only. PAN–Aadhaar linking rules, penalties, and exemptions are subject to change as per government notifications. Readers are advised to visit the official Income Tax Department website or consult a qualified tax professional for the latest and most accurate information.

Read more

Sanjay Dutt Net Worth in Rupees (2026): Movies, Businesses & Luxury Life

Bajaj Platina 110 On Road Price 2026 Revealed: Is This India’s Best Mileage Bike Yet?