PAN status check with Aadhaar : Have you recently applied for a PAN card or linked your PAN with Aadhaar and are now wondering what’s the status? You’re not alone. Thousands of people across India go through this process and are unsure how to check if everything went through properly. Luckily, checking your PAN card status using Aadhaar is now easier than ever — and you can do it from the comfort of your home, whether online, via SMS, or even WhatsApp.

PAN (Permanent Account Number) is a unique 10-digit alphanumeric number issued by the Income Tax Department of India. It’s essential for financial transactions, tax filings, and identification purposes. And when it comes to verifying the status of your PAN or the linking process with Aadhaar, there are multiple convenient options available.

Let’s walk you through the easiest methods step-by-step, so you can stay informed without any confusion.

Can You Check PAN Card Status Using Aadhaar?

Yes, you can! The government has made it extremely simple to check your PAN card status using Aadhaar through various platforms, including SMS, WhatsApp, and online portals. Let’s explore each method in detail.

Check PAN Status via SMS

Don’t have access to the internet? No worries! You can check your PAN card status via SMS. All you need is your 15-digit acknowledgement number. Just send an SMS in the following format:

Send: NSDL PAN <acknowledgement number> to 57575

Within moments, you’ll receive a text message with the status of your PAN application on the same mobile number you used during the application.

Check PAN Status via WhatsApp

This is one of the newest and easiest ways to check your PAN status. All it takes is a simple WhatsApp message.

- Open WhatsApp and send ‘Hi’ to 8096078080

- You’ll receive a consent message from Protean eGov Technologies Limited

- Reply with ‘Yes’ to proceed

- Click on the ‘Services’ option and select ‘Status of Application’

- Choose ‘PAN Application’ and enter your 15-digit acknowledgement number

And that’s it! Your PAN application status will be shared with you instantly through the same chat.

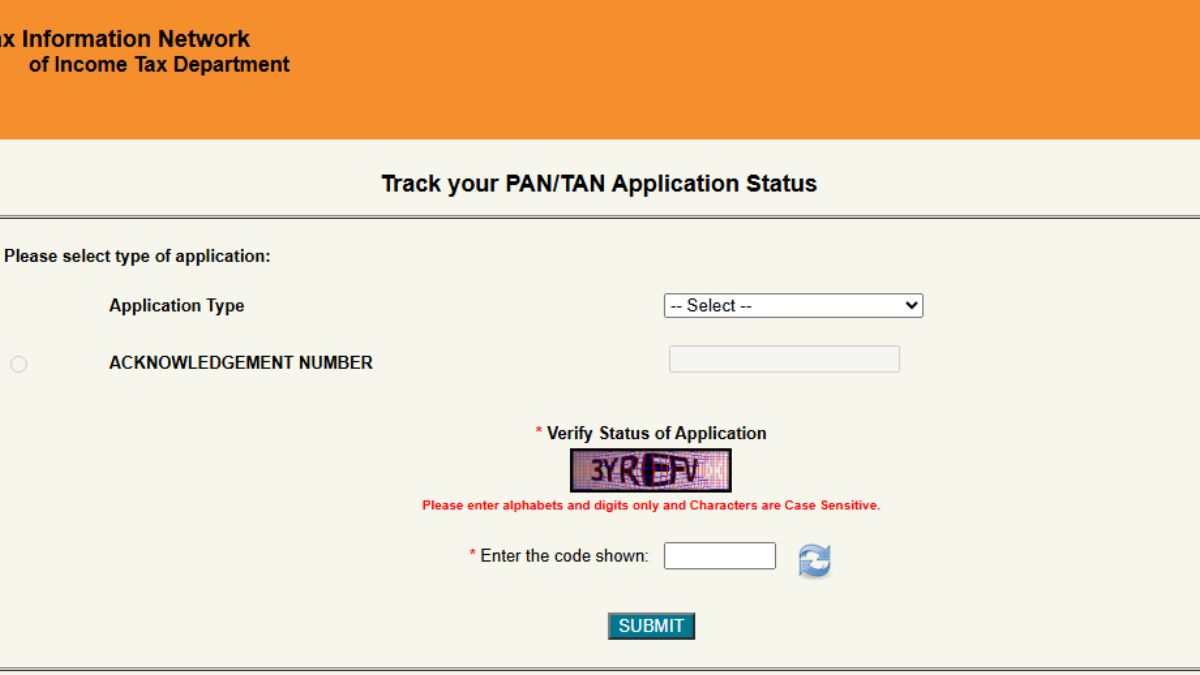

Check PAN Status Online

If you prefer using a laptop or mobile browser, checking PAN status online is straightforward.

- Visit the official TIN NSDL website

- Select the application type as ‘PAN – New/Change Request’

- Enter your 15-digit acknowledgement number

- Type the captcha code shown on the screen

- Click on ‘Submit’ to view your PAN card status

Please note: Your PAN status will be available only after 24 hours of submitting the application. So, if you just applied, wait a day before checking.

Prerequisites for Checking PAN Status

Before you start, make sure you have the following:

- Your Aadhaar number

- A mobile number linked to Aadhaar (for OTP verification)

- Internet access or mobile connectivity (depending on method used)

Step-by-Step Guide to Check PAN Card Status Using Aadhaar

Here’s how you can directly check the PAN status using your Aadhaar:

- Visit the official Income Tax e-Filing portal

- Look for the “Link Aadhaar” or “Check PAN-Aadhaar Status” option

- Enter your 12-digit Aadhaar number

- Submit the OTP sent to your Aadhaar-linked mobile number

- The screen will display your current PAN linking status

It’s fast, secure, and completely free.

Other Ways to Track PAN Status

Apart from Aadhaar, there are other helpful methods to check the progress of your PAN application:

- Use your PAN number or acknowledgement number on the NSDL or UTIITSL websites

- Try the SMS method if you’re offline

- Use the Protean eGov WhatsApp service for quick replies

- Some government mobile apps may also provide status updates

These alternatives give flexibility depending on your preferred mode of communication.

Keeping track of your PAN card status is essential, especially with the government’s push toward mandatory PAN-Aadhaar linking. Thankfully, it no longer requires a visit to an office or standing in long queues. Whether you’re comfortable with tech or prefer messaging on WhatsApp, there’s a method that suits your needs.

Make sure to keep your acknowledgement number and Aadhaar details handy and stay informed. If your PAN isn’t yet linked with Aadhaar or you face an error, you’ll have enough time to correct it and avoid penalties.

Disclaimer: This article is intended for informational purposes only. Users are advised to refer to the official websites of the Income Tax Department, NSDL, or UTIITSL for the most accurate and updated information. We do not collect or store any personal data and are not affiliated with any government agency.

Read more

PM Awas Yojana 2025: Eligibility, Required Documents & Online Application Process